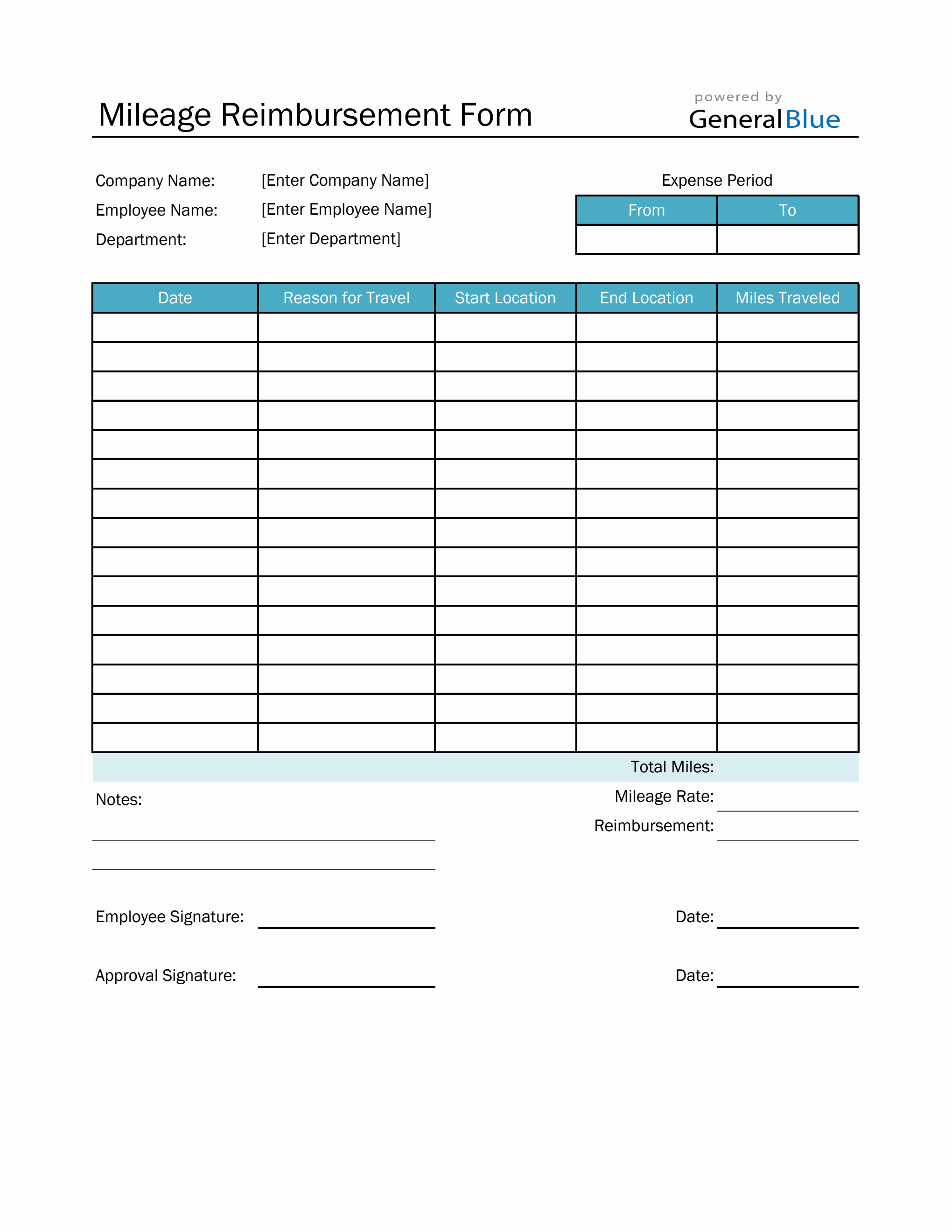

2024 Mileage Reimbursement Form. The irs has announced the new standard mileage rates for 2024. Receipts are not required for mileage and per diem.

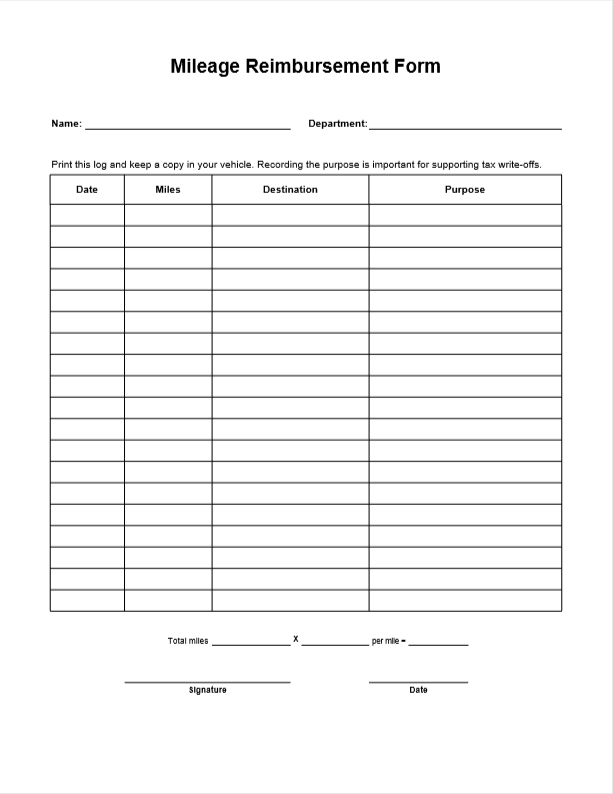

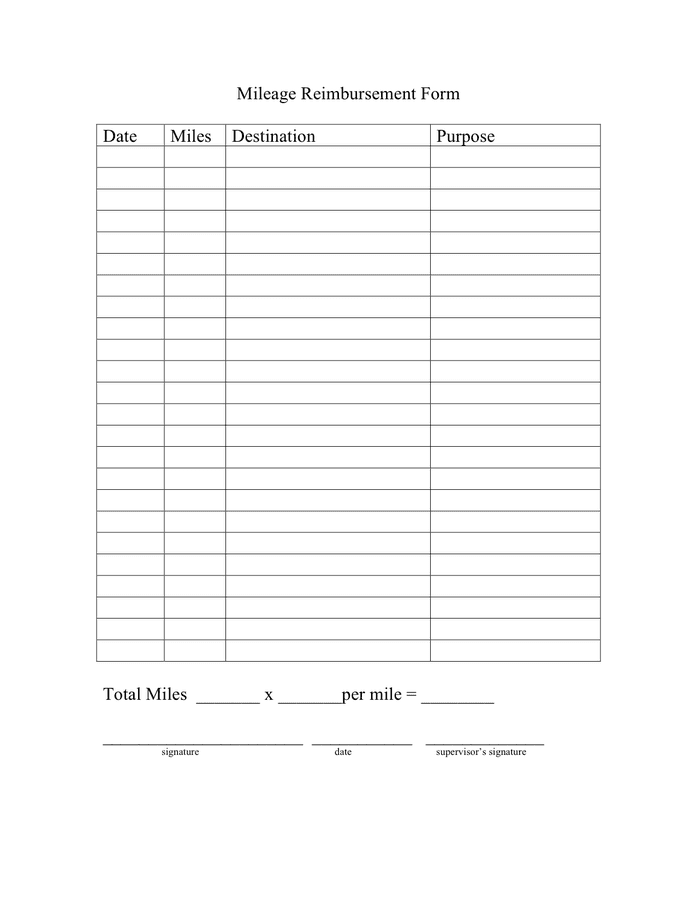

Car expenses and use of the. A sample form for an employee to request mileage reimbursement for business related travel.

2024 Mileage Reimbursement Form Images References :

Source: lannibhaleigh.pages.dev

Source: lannibhaleigh.pages.dev

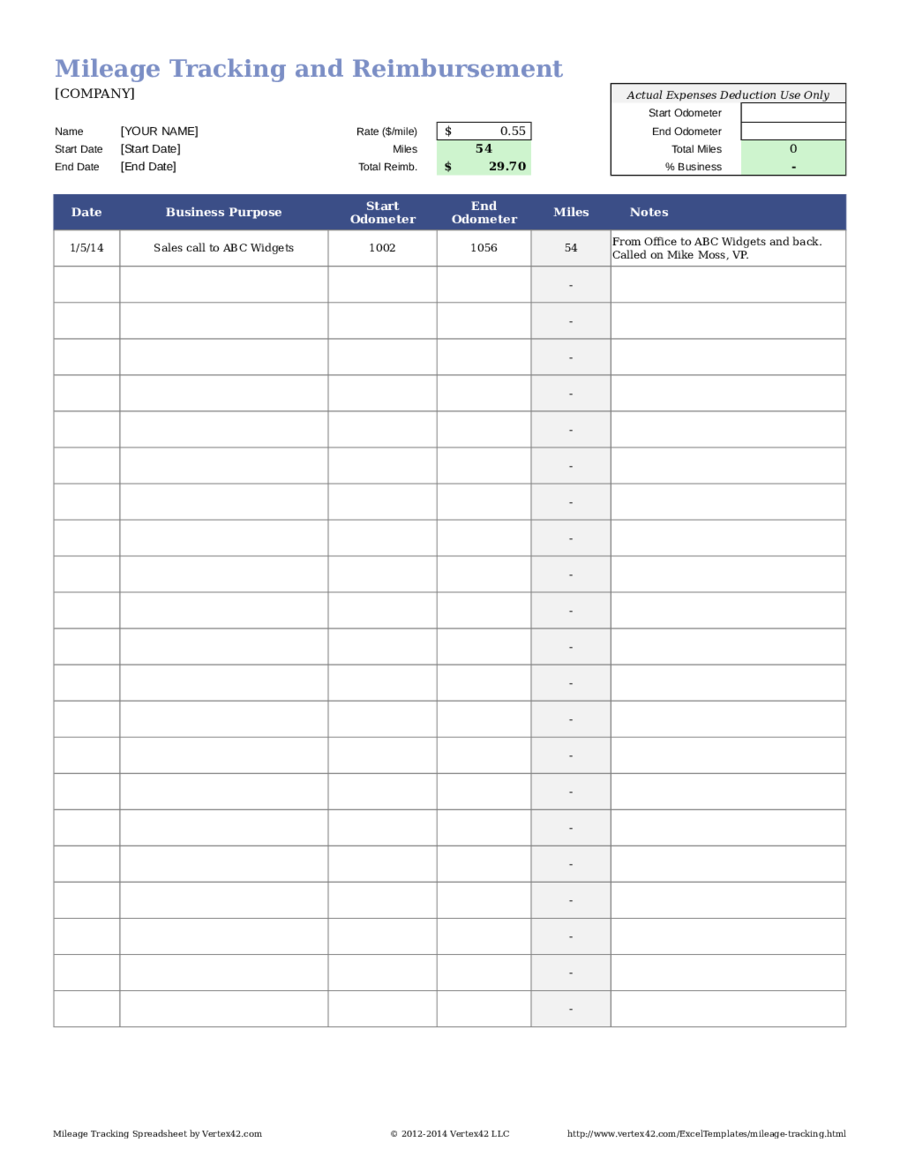

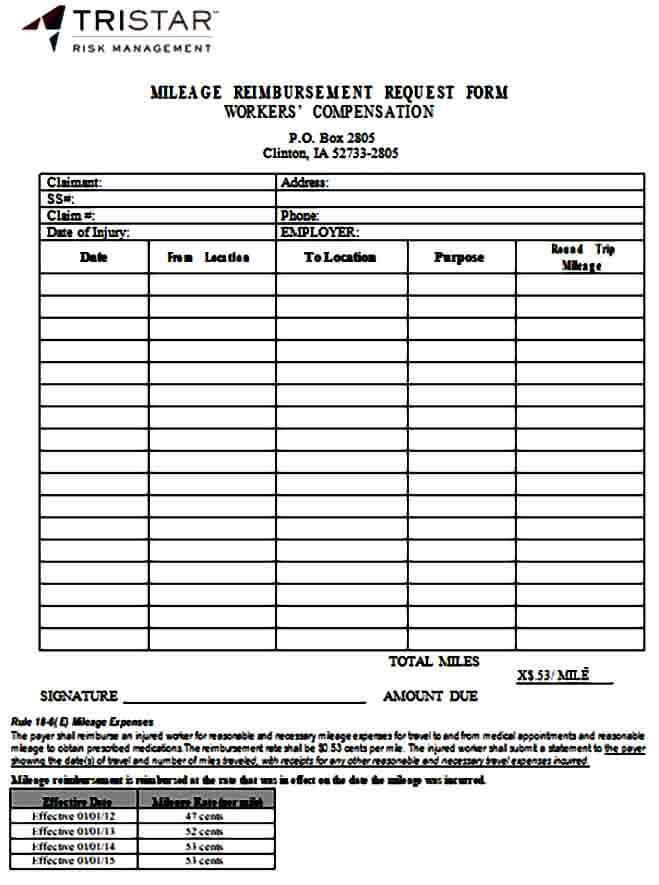

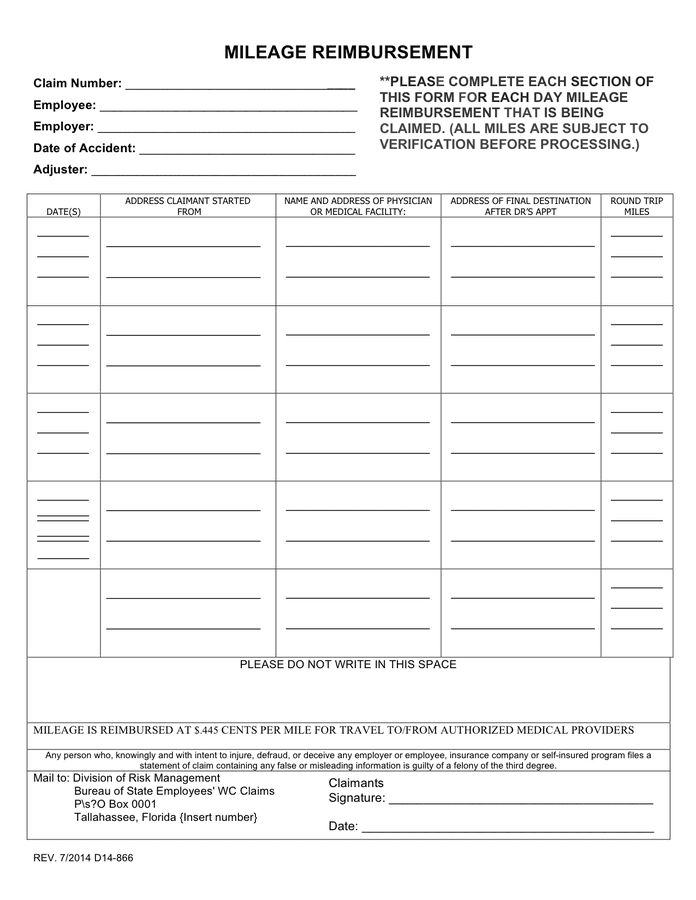

Mileage Reimbursement 2024 Karee Karrah, Gsa has adjusted all pov mileage reimbursement rates effective january 1, 2024.

Source: doniabelianore.pages.dev

Source: doniabelianore.pages.dev

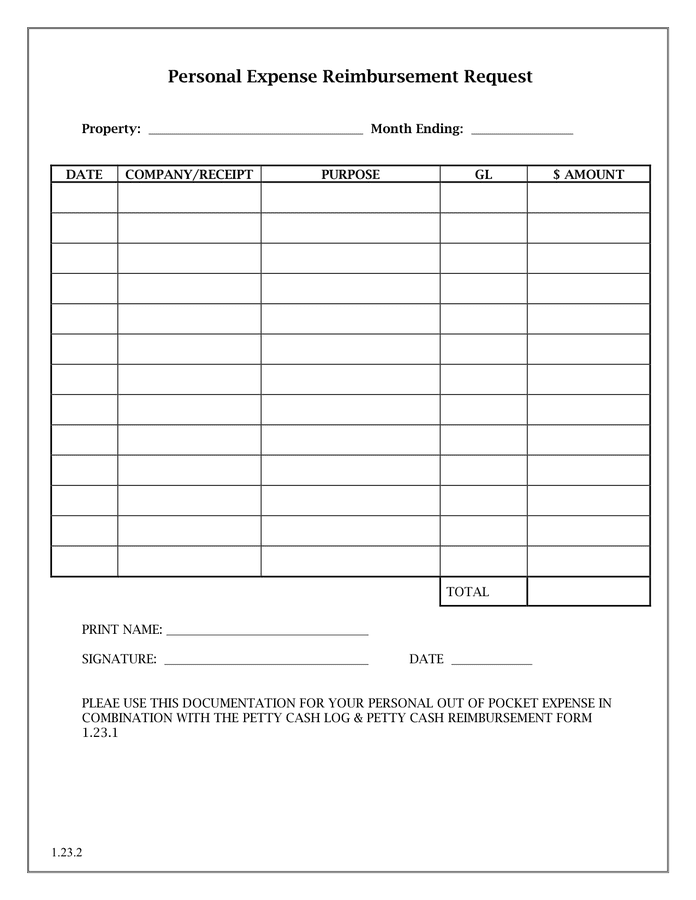

2024 Mileage Reimbursement Rate Form Dorry Gertrud, The way you calculate business mileage and your type of business determine which forms you file.

Source: salomawlexis.pages.dev

Source: salomawlexis.pages.dev

2024 Mileage Reimbursement Rate Chart Uspto Tonie Antonietta, Receipts are not required for mileage and per diem.

Source: imogengilberte.pages.dev

Source: imogengilberte.pages.dev

Mileage Reimbursement 2024 Forms Microsoft Arlyn, The irs provides specific guidelines on mileage reimbursement to ensure consistency and fairness.

Source: dacieqjonell.pages.dev

Source: dacieqjonell.pages.dev

Irs Mileage Reimbursement 2024 Form Sam Leslie, Receipts are not required for mileage and per diem.

Source: www.generalblue.com

Source: www.generalblue.com

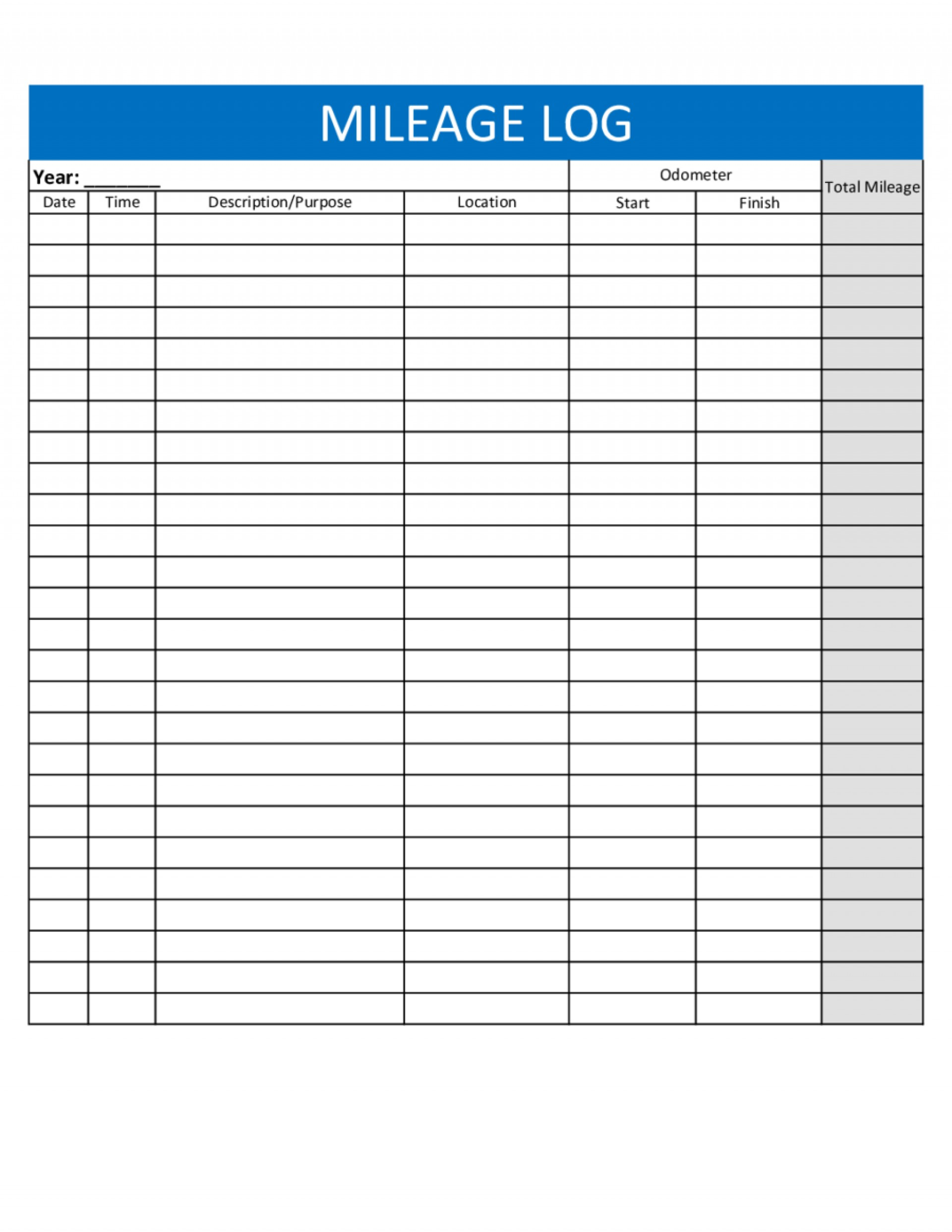

Mileage Reimbursement Form in Excel (Basic), Medical mileage expense form 2024.

Source: darbqdiahann.pages.dev

Source: darbqdiahann.pages.dev

Ca Mileage Reimbursement 2024 Form Aggie Marianna, Use the calculator below to quickly estimate your mileage reimbursement for 2024 or previous years.

Source: myrtayjourdan.pages.dev

Source: myrtayjourdan.pages.dev

Mileage Reimbursement 2024 Form Pdf Download Aubrie Daniele, Medical mileage expense form 2024.

Source: deloracristin.pages.dev

Source: deloracristin.pages.dev

California Car Mileage Reimbursement 2024 Amii Lynsey, For 2023, the standard mileage rate for the cost of operating your car for business use is 65.5 cents ($0.655) per mile.

Source: glyndableanora.pages.dev

Source: glyndableanora.pages.dev

Mileage Reimbursement 2024 For Electric Vehicles 2024 Faunie Emmalynn, A sample form for an employee to request mileage reimbursement for business related travel.

Posted in 2024